Explore our Services

Helping you drive competitive advantage

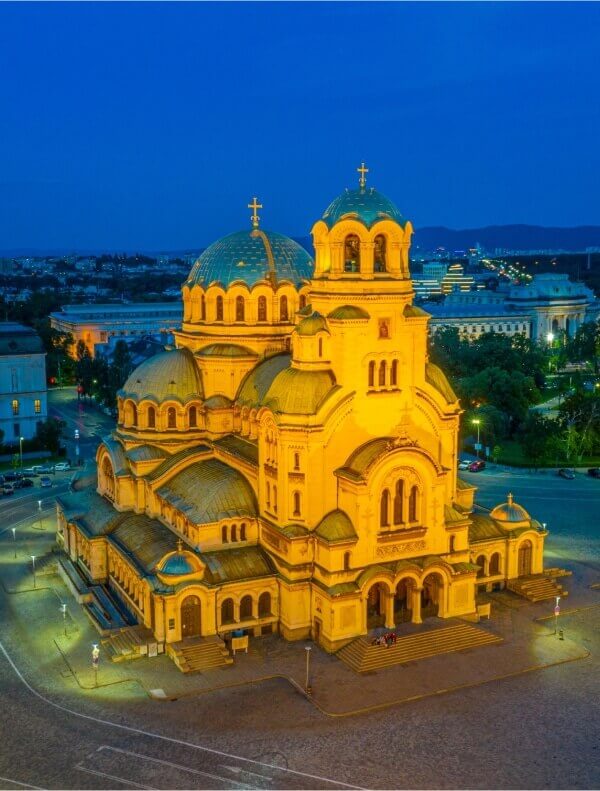

Discover our global locations

Stay informed. Stay ahead.

Latest whitepaper

Reimagine Customer Experience Management on Social Media

Experience a new world of work

Explore Opportunities

The ResultsCX difference

Enhancing Merchant Relationships through Strategic Engagement for a Leading US Bank

Enhancing Merchant Relationships through Strategic Engagement for a Leading US Bank

Industry

In today’s competitive financial services landscape, banks face increasing pressure to deliver differentiated value to their business customers—particularly in merchant services. For top-tier merchants, poor account engagement, lack of personalized support, and missed growth opportunities can quickly translate to churn or stagnation. Amid a commoditized market where customer loyalty is fragile, a leading U.S. bank recognized the urgent need to rethink its merchant engagement strategy.

With over 100,000 merchants and $6.75 billion in annual charge volume at stake from a high-potential segment, the bank partnered with Aucera, a ResultsCX company, to elevate relationship management, deepen loyalty, and uncover untapped growth.

With over 100,000 merchants and $6.75 billion in annual charge volume at stake from a high-potential segment, the bank partnered with Aucera, a ResultsCX company, to elevate relationship management, deepen loyalty, and uncover untapped growth.

The Challenge:

The bank identified approximately 5,000 merchants whose transaction volumes made them vital to long-term revenue growth but also most susceptible to competitive poaching. CX challenges included:

- Lack of proactive account management, leading to missed retention and upsell opportunities

- Limited visibility into merchant needs, making it harder to personalize support or recommend growth solutions

- Disjointed engagement processes that failed to build trust or demonstrate value beyond basic transaction handling

- Inefficient outreach, impacting agent productivity and operational ROI

The bank needed a model that combined personalized outreach with structured insights to drive both retention and expansion.

The Solution:

To address these issues, Aucera deployed a strategic “Pod” engagement model—a one-to-one relationship management framework where specialized agents acted as dedicated account managers for assigned merchants.

This approach was anchored by three structured touchpoints:

- Outreach & Introduction

Agents proactively introduced themselves as service managers, establishing trust while gathering contextual data about each merchant’s business. - Customer Insight Review

Using tailored insight reports, agents collaborated with merchants to assess account health and identify stabilization or growth actions. - Follow-up & Value-Added Solutions

Armed with merchant data, agents delivered targeted recommendations—from process education to marketing cross-sell opportunities—aimed at reinforcing the relationship and driving value.

Throughout the process, the team emphasized personalization, timely follow-through, and measurable results, addressing the service gaps often seen in traditional merchant relationship models.

The Results:

- $4.6M in recovered charge volume within the first 6 months of the program

- 67% first engagement rate across the entire target merchant portfolio

- 95% total contact rate, significantly improving reach and responsiveness

- 474 revenue opportunities identified, representing $175.1M in potential charge volume

- 25% of opportunities converted, generating $28.2M in additional charge volume

- 161% increase in engagement efficiency, from 0.31 to 0.81 engagements per hour

- 93% quality score and 95% data integrity, maintaining CX excellence at scale

- 80% headcount growth, demonstrating program scalability and impact

By prioritizing proactive, data-driven engagement, the bank not only strengthened its merchant relationships but also unlocked significant revenue opportunities in a highly competitive market. This case underscores how personalized CX strategies, when combined with structured insights and consistent follow-through, can redefine value delivery in banking.