Explore our Services

Helping you drive competitive advantage

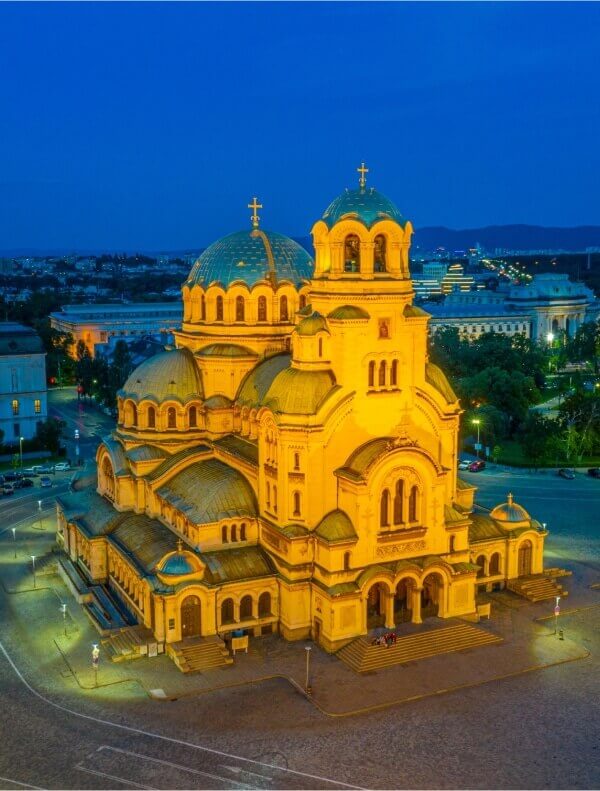

Discover our global locations

Stay informed. Stay ahead.

Latest whitepaper

Reimagine Customer Experience Management on Social Media

Experience a new world of work

Explore Opportunities

The ResultsCX difference

Global Bank Transforms Collections: Cuts Complaints by 44% and Realizes 500K in Surplus Training Budget

Global Bank Transforms Collections: Cuts Complaints by 44% and Realizes 500K in Surplus Training Budget

Industry

Streamlining the collections and recovery function is crucial for enhancing customer outcomes and reducing regulatory scrutiny. Efficient processes ensure timely debt resolution, improving customer satisfaction and loyalty. Moreover, by minimizing errors and compliance risks, streamlined operations help avoid regulatory penalties and maintain a positive brand reputation.

The Challenge:

Upon identifying issues leading to poor customer outcomes and regulatory scrutiny, our client, leading bank, realized a need for substantial improvements in their collections operations. Determined to better support their customers in financial distress, the bank reached out to ResultsCX to help transform their collections and recovery function.

The objective was clear: streamline processes, enhance customer engagement, and improve the first time-right metric to significantly boost customer satisfaction. By focusing on accurate and empathetic communication from the outset, the bank aimed to deliver a smoother experience and improve outcomes for their customers.

The Solution:

ResultsCX, a long-time CX partner to the client, designed and managed a dedicated ringfenced operation with the goal of improving productivity and getting the bank within its SLA. The operation deployed 27 collections experts with specialized knowledge in repayment plans, Individual Voluntary Arrangements (IVAs), bankruptcy, and forbearance options. The experts were also equipped with the communication and empathy skills necessary to effectively engage with vulnerable customers.

To further bolster the team’s effectiveness, we delivered a bespoke training solution tailored to enhance their capabilities. This comprehensive training not only equipped the team with advanced technical skills but also emphasized the importance of empathy and clear communication in customer interactions.

The Results:

The impact was significant and measurable. Collections complaints, which had been a major concern, decreased from 910 to 510 per month. The reduction highlighted the success of our targeted approach and underscored our commitment to improving customer outcomes while addressing their financial challenges with sensitivity and professionalism.

- Reduced complaints by 44%.

- Completed project delivery 3 months ahead of schedule.

- Redirected resultant cost savings of ~$500K to additional training, enhancing the BAU team’s ability to identify and handle customers in financial distress.