Explore our Services

Helping you drive competitive advantage

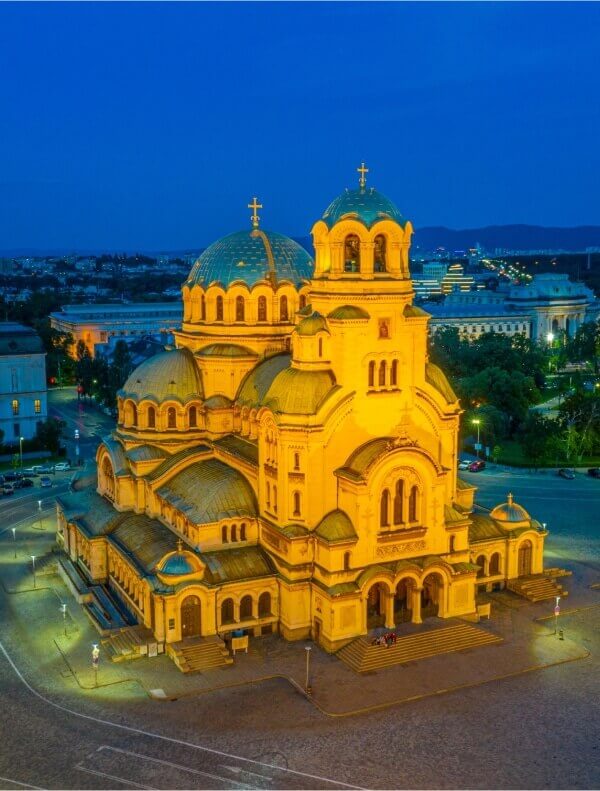

Discover our global locations

Stay informed. Stay ahead.

Latest whitepaper

Reimagine Customer Experience Management on Social Media

Experience a new world of work

Explore Opportunities

The ResultsCX difference

Global Bank Powers Through Backlogs, Boosts Customer Satisfaction and Fraud Prevention

Global Bank Powers Through Backlogs, Boosts Customer Satisfaction and Fraud Prevention

Industry

Quickly clearing backlogs of potential fraud cases is essential for providing good customer outcomes and preventing future issues. Timely resolution ensures that legitimate transactions are processed without delay, enhancing customer satisfaction and trust. Additionally, prompt action reduces the risk of financial loss and helps identify and address fraudulent patterns early, safeguarding both the bank and its customers from future fraud attempts

The Challenge:

Our client, a leading retail bank, found themselves grappling with a daunting backlog of complex fraud cases. The successful resolution of this backlog was essential not only for delivering positive customer outcomes but also for mitigating significant risks to the bank. These fraud cases were complex, requiring the nuanced expertise of highly experienced fraud specialists who possessed both deep financial crime knowledge and exceptional customer communication skills.

Recognizing the urgency of the situation, the bank understood that merely increasing manpower wouldn’t suffice. They needed experts who could swiftly and effectively untangle the cases while maintaining clear, empathetic communication with customers. The challenge lay in not only identifying these specialized professionals but also deploying them rapidly to address the backlog.

The Solution:

The ResultsCX team promptly swung into action, leveraging our unrivaled access to high-caliber resources to source, vet, and deploy individuals with the right blend of financial crime knowledge and customer communication skills. The 20-member team efficiently cleared the client’s case backlog, providing communicative and responsive service for customers.

Our approach ensured fair and accurate case decisions, vital for meeting our client’s seven-week SLA and preventing further backlogs. By running a ‘split shift’ operation, we implemented a flexible customer contact strategy, allowing our experts to effectively manage their investigative work alongside their customer contact schedule. This maximized our utilization and supported the timely completion of the project.

The Results:

The pace of deployment and proficiency of our team underscored our commitment to customer service excellence for this longstanding client of over 12 years.

- Deployed 20-member technical team within four weeks.

- Cleared a backlog of 650 complex cases.

Thrilled with the results, the client expanded our engagement to include:

- Extended support across three additional workstreams within their financial crime department.

- Increased the number of resources to 30, demonstrating their confidence in our team’s fraud prevention capabilities and depth of knowledge.