Explore our Services

Helping you drive competitive advantage

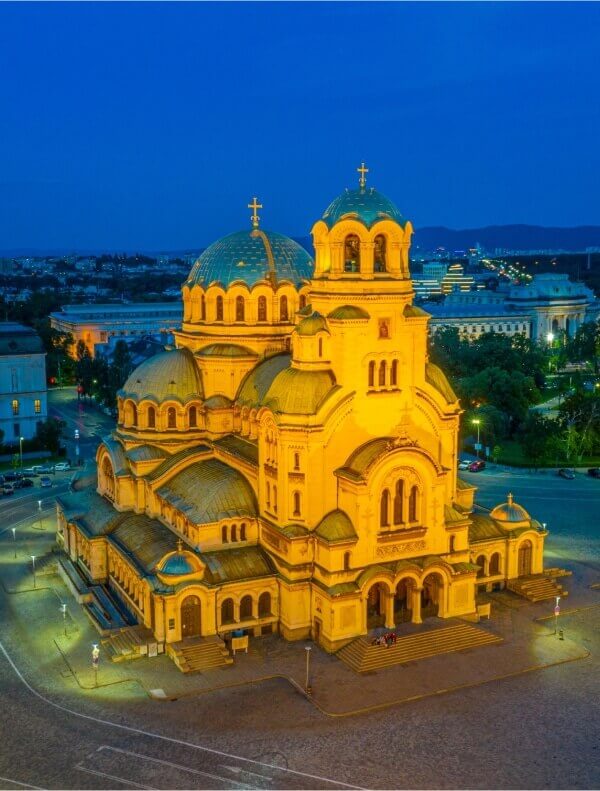

Discover our global locations

Stay informed. Stay ahead.

Latest whitepaper

Reimagine Customer Experience Management on Social Media

Experience a new world of work

Explore Opportunities

The ResultsCX difference

From reactive risk to predictive ROI:

Redefining CX operations in banking and financial services

Stop reacting to high call volumes – start preventing the issues that cause them. Discover how AI-driven intelligence and human-centric operations are helping leading banking and financial institutions lower cost-to-serve while strengthening regulatory compliance.

A THOUGHT LEADERSHIP PAPER WITH:

Why the reactive CX model is costing you more than just money

The banking and financial services sector is at a breaking point. Reactive contact center models inflate cost, widen operational risk, and erode customer trust, especially in regulated interactions where accuracy and consistency are critical.

Our latest whitepaper, produced in collaboration with ISG, outlines the structural CX shift and shows that forward-looking institutions are responding with predictive CX – an intelligence-led approach that identifies friction early and enables proactive intervention before issues escalate.

This whitepaper examines:

- Why reactive service models no longer scale

- How predictive CX shifts operations from firefighting to foresight

- Why CFOs, COOs, CX leaders, and Risk teams are aligning around this model

- How ResultsCX operationalizes predictive CX at scale across BFS environments

Download the whitepaper

What you’ll learn

Why BFS CX is at a breaking point

Understand how rising call volumes, long training cycles, and regulatory complexity are pushing reactive models beyond their limits

From resolution to prevention

Learn how banks are using AI, behavioral data, and signal intelligence to detect issues earlier and reduce avoidable contact

Why predictive CX is gaining board-level attention

See how CFOs, COOs, CX and Risk leaders view predictive CX as a lever for cost stability, compliance, readiness, and trust

What leading BFS institutions are doing differently

Explore how early adopters target high-value journeys like fraud, payments, onboarding, and collections to drive measurable impact

How ResultsCX turns predictive insight into operational results

Discover real-world examples of predictive outreach, guided execution, and workflow orchestration delivering improved recovery, lower cost-to-serve, and faster agent proficiency

A leadership playbook for CX, Finance, and Operations

Practical guidance for embedding predictive CX as an enterprise capability – not just a point solution

Many industries have moved from fixing problems to preventing them. Banking, despite its history of early technology adoption, continues to rely on reactive service models. As financial services become more transactional and customer tolerance declines, predictive engagement will become essential to maintaining trust and control.

Jon Lightman

Partner, US Banking and Financial Services Practice

ISG

Who should read this

-

CX Leaders

Redesign journeys for early intervention and lower customer effort across onboarding, servicing, and retention. -

CFOs & Finance

Link predictive CX to cost stability, avoided interactions, and measurable ROI across high-volume journeys. -

COOs & Operations

Build governance and execution discipline with precise trigger logic and real-time agent guidance. -

Risk & Compliance

Strengthen control with early anomaly detection, and improved audit readiness.

Why ISG + ResultsCX

ISG brings independent research and market insights into how predictive CX is reshaping BFS service models globally. ResultsCX provides the execution layer – helping banks convert early signals into real-time action through predictive outreach, agent intelligence, and operational agility. Together, through this whitepaper, we offer a clear view of what predictive CX looks like in practice and how to make it work at scale in regulated environments.

Key takeaway

Predictive CX is no longer experimental. It is the foundational operational layer for BFS institutions seeking lower cost-to-serve, stronger compliance outcomes, and more resilient customer relationships. Institutions that act early will stabilize operations and build trust while those that remain reactive will continue to absorb rising cost and risk.